Could it be your best option to sell your business to your employees? Is it reasonably achievable? This piece considers both those questions. It mentions some of the advantages of selling an ownership interest to the company’s employees and provides some insight into how the employees could raise the necessary funds.

Many of those selling mid-sized companies, with 7-figure values, mistakenly assume that their company’s employees (including its management team) would not be able to afford the purchase and so deprive themselves of a sale that may have been in their best interests.

The benefits of selling to employees include the following:

- Lower transaction costs – since there is no need for a business broker, much less need for financial and operational due diligence, and there should be savings on lawyer and accountant fees.

- Far less hassle – since little (if any) financial and operational due diligence will be needed

- The risk for the buyer is lower – because there would be far less risk of staff, customer and/or supplier loss post sale and there would be less risk of the buyer not knowing about a looming problem – and due to that lower risk, the employee buyers (and any who invest alongside them) could justify paying a higher price for the business.

- There is far less risk of the buyer retrenching long-serving staff who have been loyal to you and your business, so there is less risk of your employees coming to the view that you ‘sold them out for your personal enrichment’.

- The business brand that you spent so much time and effort building, is more likely to be retained.

- If arranged correctly, from the time you give your employees the opportunity to start buying in (investing in or buying shares from you), you can reasonably expect them to be more loyal, to be more focussed on reducing unnecessary costs and increasing profits, and to be more motivated to ensure your business thrives. All of which should enhance the financial performance of your business, which should increase the value of your business and increase your net sale price.

- A progressive sale, which is much more achievable where the business is sold to employees, enables you to gradually wind down your involvement in the business, at your preferred pace, from full-time in the business, to working only on the business, then to only attending board meetings and finally to fully exiting the business.

- A progressive sale of your business enables you to gradually reduce your involvement in the business, which significantly reduces the risk of suffering mental health problems from the sudden loss of relevance experienced by many who experienced a sudden (even if planned) exit.

- A progressive sale of your ownership interest to employees gives bankers and prospective co-investors confidence that key personnel won’t leave post sale, that the current owner has a vested interest in ensuring a smooth transition, that customers and suppliers will remain and that there are no undisclosed looming problems. This reduction in risk for co-investors and banks should increase the prospect of the sale going ahead and increase the prospect of you getting a higher sale price.

- A sale to a consortium comprising third party investors and an employee group, could attract a new class of buyers, passive investors willing and able to pay a higher price for any given expected return on investment. These people could invest in a portfolio of top-tier listed companies, probably trading on PE multiples of over 25 times (4% pa return on investment) or could invest in your business for a reasonable expectation of a far higher return on their investment, multiples higher!

If these potential benefits, or some of them, could appeal to you, you may wish to consider whether a sale to your company’s employees would be reasonably achievable. If so, here is an arrangement that could increase prospects of success in that regard.

How to achieve it, a sale to employees

- Start the process early, give your employees (including management) a few years to buy a substantial (20% +) shareholding from you.

- Pay performance bonuses in scrip to an employee share ownership trust (ESOT) then do a share buyback (from you) with those funds – so the performance bonuses are effectively used to buy your shares.

Consider a performance bonus arrangement whereby a material proportion (say 50%) of the additional profits or return on capital over current levels, are paid as performance bonuses.

Employees should generally share equally in this bonus, with some who have gone above and beyond receiving more. Once employees discover that they get 50% (50 cents in every $1) of cost savings, and 50% of net revenue increases, they will be a lot more focussed on eliminating unnecessary costs and increasing returns on capital.

Similar approaches to remuneration have been adopted by the world’s most successful leaders. Genghis Kahn, for example, used it to build an army that defeated the world’s most advanced civilisations at the time, the Khwarazm Empire, the Chinese Western XIA and Jurchen Jin Empires, and his grandson, Kublai Khan, used it to defeat the mighty Song Empire. Prior to his ascension to power, the Mongol clans allocated their spoils of war mainly to the nobles and elites, with little (if any) going to the ordinary soldier. Genghis Khan’s soldiers generally shared equally in the spoils of war, with those who outperformed getting more. It was largely for this reason that more and better skilled people joined his army. Business, like war, is competitive. So, if you want to win you need more and better people fighting on your side to increase profits and returns on capital. One of the best ways to achieve this, is to give them a handsome share of the extra profits.

- Either provide a ‘vendor loan’ (interest bearing and subject to a repayment plan) to the ESOP to enable it to buy a further circa 20% of your ownership interest from you or retain that ownership interest until you decide to fully exit the business, after say 5 to 10 years. By retaining such a substantial shareholding, one likely to be more than that of any other individual, you should be able to retain a seat on the board and a substantial ‘say’ in the affairs of your business.

- Together with your management team and other employees, invite others (passive investors and perhaps also suppliers and B2B customers) to purchase a parcel (15-20%) of your shares from you.

- Leverage the business to fund a buyback of your remaining shares (excluding the portion you intend to hold until your final exit from the business).

Banks will be far more included to lend to the business (on a standalone basis, without personal guarantees) where the management team stays on and holds a material shareholding in the business, where many employees have invested in the business (directly or through the ESOP) and where other investors also hold a substantial proportion of the shares.

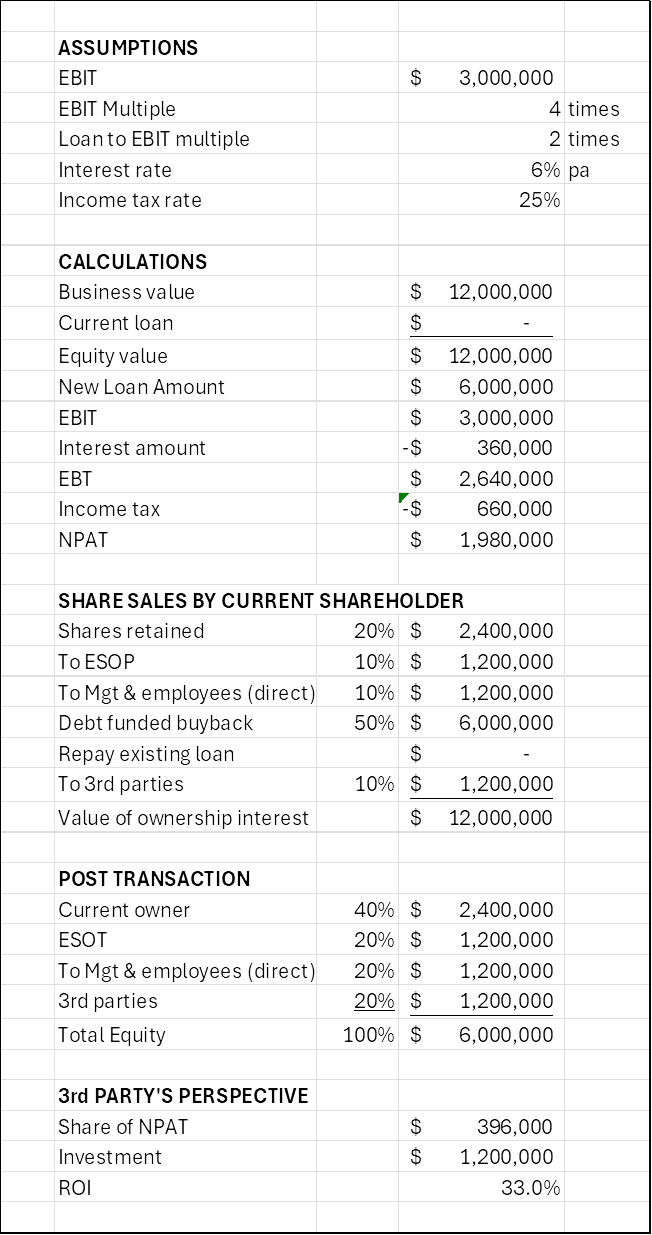

A numerical example reflecting the arrangement outlined above is set out in ‘Annexure A’ below. In this scenario various parties (employees, management and other) bought shares from the owner, who retained a strategic shareholding, in a business valued on a 4 times EBIT multiple and leveraged to the extent of two times EBIT. At that multiple, those parties would expect a return on investment of 33% pa. Many would find such a return expectation to be attractive – especially when compared against the expected return from a portfolio of equity investments in top listed companies. Their associated indexes are generally commanding PE ratios of over 25 times, 4% pa.

In conclusion

If your preference is to gradually reduce the size of your ownership interest and gradually reduce the time you spend working in and on your business, then a sale to your employees (including your management team) should be worth considering.

It should also be worth considering where you plan to sell in the foreseeable future to an acquirer who would prefer to retain your staff, customers and suppliers, and be concerned about looming problems it may not be aware of. Having your management team and other employees co-investing with you, together with your being willing to retain a meaningful shareholding in your business, should give prospective investors and other acquirors comfort that all is well with your business and that the sale will have little (if any) adverse effect on the business. Given this lower risk, it could justify paying you a higher price for your shares.

There are however situations where it may not be in your best interest to sell or issue shares to management, other employees and to third parties. One such as is where the prospective acquirer only sees value in your product or IP. Even in such situations it may be worthwhile having management and other employees as shareholders – because they would be more likely to be more motivated to improve the product at the lowest cost.

I hope you found this piece interesting and useful.

—————————————————–

Annexure A