This piece discusses three issues that are seldom given sufficient consideration by business owners when contemplating retirement. One is, what impact will a sale of the business have on their annual income? Another is, what the impact will the sale have on your mental health, and a third is whether to sell the business to one of their children.

In considering the first question (the impact of a sale on their annual income) you need to distinguish investment income (dividends) from income derived from working in the business.

To state the obvious, if you sell your business, you will lose the income you would otherwise have earned from working in the business, such as salary, performance bonuses, company vehicles, and personal expenses paid by the company. You would generally lose all that income on settlement or if the sale is subject to an earnout, lose some of it on settlement and the rest by the time that earn-out period has elapsed.

If you decide not to sell but appoint one or more people to run the business for you, your income from working in the business could gradually reduce, as you transition from working a 5- day week to 4 days, then to 3 and so on until you are no longer working in the business. In such a scenario you would stay on the board and could justifiably have the business pay you a fee for that role. At some point in time, you would relinquish that role as well. This additional income should be considered in deciding whether it is in your best interests to sell.

If you sell the business, you can invest the net sale proceeds. If you decide not to sell, you’ll get dividends from your business. So, it is important to recognise the difference in the expected returns from these alterative options. For this you’ll need to do some math.

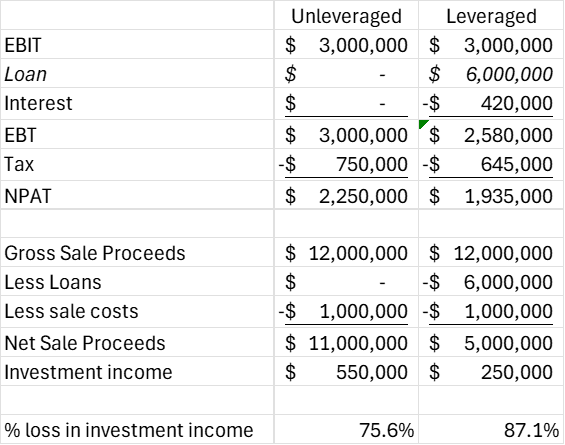

Here is an example where I have assumed a $3 million EBIT business sells (on a 4-times EBIT multiple) for $12 million. Any debt needs to be deducted from this figure as do the costs of selling the business (business broker, lawyers, and so on). You’ll notice from the table below that I’ve assumed $1 million in sale costs and in one case $6 million in debt (2 x EBIT) at a 7% pa interest cost and in the other case there is no debt. I have also assumed a 25% income tax rate.

You’ll also notice that I have assumed the expected return that you will earn on your net sale proceeds is 5% per annum. Here’s why I made that assumption:

If you sought the advice of a wealth manager you would probably be advised to invest your net sale proceeds in diversified portfolios of shares in top-listed companies, listed property trusts and bonds. In the current market, the aggregate of the dividend and interest income from such a portfolio is likely be less than 5% per annum of the capital invested, and even less post tax. [The current 10-year Australian Government Bond yield is about 4.45% and the S&P/ASX 200 is trading on a dividend yield of about 3.7 times (as at end Jan. ’25)] So, your potential annual income (dividends and interest) would, in the current market, probably be less than 5% per annum.

The calculation and result are set out in the table below:

Both sale scenarios show a significant loss of annual investment income compared to retaining ownership of your business. Ouch! This is in addition to the loss of salary and other drawings you make from your business. Double ouch!

The calculation did not include capital appreciation on the investment portfolio or on your business because it applies to both sides. Unless it is likely that it will differ materially between the two, listed shares and units on the one hand and that for your business on the other, it is reasonable to exclude it from both sides. If it is expected to be materially different, the difference should be included in the calculation.

Another major consideration in determining whether to sell your business is the impact retirement may have on your mental health. One generally assumes this would be positive – since you’ll have more time to relax and exercise and generally potter about. The reality for many is quite different. The sudden and dramatic loss of relevance can have an adverse impact on one’s mental health. As the owner/ operator your staff, customers and suppliers bring problems to you to solve up to the day you retire. Thereafter you are of no need to them – so your phone stops ringing. This loss of relevance can be hard on one’s mental health. And that’s not the end of it. Once you retire, you’ll be spending considerably more time at home, and that change may not sit that comfortably with your wife. She may adore you but suddenly having you home 24/7 could put strain on your relationship.

Given the above, there is a lot of merit in not selling your business and gradually transitioning to full retirement. During this transition you could give staff and others the opportunity to invest in your business and you could gradually sell down your stake to them should you need additional cash or wish to diversify your investment portfolio.

A third consideration arises where one of your children is working in the business and could run it. In this case, do you sell your business to that child? Many do and when they do, they give the child favourable payment terms. Such arrangements cause family problems, as the one taking over the business will be considered by your other children to have received much more. A potentially far more harmonious arrangement would be to retain ownership of your business (or transfer it into a family trust) and pay your child a market related salary package (salary and performance bonus) for working in the business.

Whether you expect one of your children to take over from you as the CEO or one of your senior staff is to be appointed to run the business, it is best to gradually transition the preferred person into your role, where over time you relinquish more and more responsibilities to the appointed person. A transition is also wise where you recruit an experienced executive to take over as the CEO, but that transitioning period could be a lot shorter.

R&M can assist you and your business make this transition – from you working in your business to working on it, and ultimately to being comfortable not working in or on it but still retaining an ownership (directly or through a family trust) in it. Follow this link for more information on what R&M does, why and how – https://www.rogersmorris.com.au/rm-advisory/